Answer:

4 years

Step-by-step explanation:

Given;

Purchasing cost of the vehicle = $50,000

Salvage value = $10,000

Depreciation expense = $5,000

Depreciation account at the end of the current year = $20,000

Now,

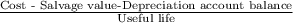

Annual Depreciation expense using the straight-line method is given as;

=

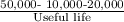

=

or

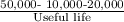

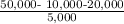

Depreciation expense =

also,

Depreciation expense = $5,000

thus,

$5,000 =

or

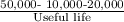

useful life =

or

useful life = 4 years