Answer:

Machine I

capitalized cost: 230,271.28

EAC: $ 27,047.58

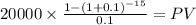

Machine II

EAC: $ 27,377.930

As Machine I cost per year is lower it is better to purchase that one.

Annual deposits to purchase Machine I in 20 years: $ 1,396.770

return of machine I with savings of 28,000 per year: 10.51%

Step-by-step explanation:

WE calculate the present worth of each machine and then calculate the equivalent annual cost:

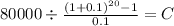

MACHINE 1

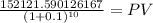

Operating cost:

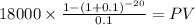

C 18,000

time 20

rate 0.1

PV $153,244.1470

Salvage value:

Maturity $20,000.0000

time 20.00

rate 0.1

PV 2,972.87

Total: -80,000 cost - 153,244.15 annual cost + 2,972.87 salvage value:

Total: 230,271.28

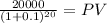

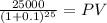

Present worth $(230,271.28)

time 20

rate 0.1

C -$ 27,047.578

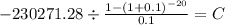

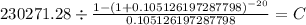

Fund to purchase in 20 years:

FV $80,000.00

time 20

rate 0.1

C $ 1,396.770

IF produce a 28,000 savings:

we must solve using a financial calcualtor for the rate at which the capitalized cost equals 28,000

PV $230,271.28

time 20

rate 0.105126197

C $ 28,000.000

rate of 0.105126197 = 10.51%

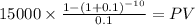

Machine II

100,000 cost

25,000 useful life

15,000 operating cost during 10 years

20,000 for the next 15 years

Present value of the operating cost:

C 15,000

time 10

rate 0.1

PV $92,168.5066

C 20,000

time 15

rate 0.1

PV $152,121.5901

in the timeline this is at the end of the 10th year we must discount as lump sum for the other ten years:

Maturity $152,121.5901

time 10.00

rate 0.1

PV 58,649.46

salvage value

Maturity $25,000.0000

time 25.00

rate 0.1

PV 2,307.40

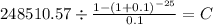

Total cost: 100,000 + 92,168.51 + 58,649.46 - 2,307.40 = $248,510.57

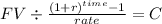

PV $248,510.57

time 25

rate 0.1

C $ 27,377.930