Answer:

13.86%

Explanation:

Data provided in the question:

Forecasted value bond portfolio one year ahead = $105 million

Expected value to be received = $10,000,000

Worth of bond portfolio today = $101 million

Now,

The Forecasted return is calculated as;

= [(Coupon + closing value - opening value) ÷ (Opening value)] × 100%

on substituting the respective values, we get

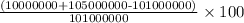

Forecasted return =

or

Forecasted return = 0.1386 × 100%

or

Forecasted return = 13.86%