Answer:

$36.07

Step-by-step explanation:

Given:

Dividend paid = $2.07 per share

Increase in dividend = 15%

Duration = 10 years

Expected growth in annual dividend = 3.3% = 0.033

Required return = 10.3% = 0.103

Now,

D1 = $2.07 × (1 + 0.15)

= $2.3805

D2 = $2.3805 × ( 1 + 0.10)

= $2.61855

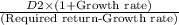

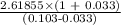

Value after year 2 =

=

= $38.642

Hence,

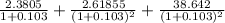

Current price = Future dividends × PVAF(10.3%,time period)

=

= $36.07