Answer:

$2,091,000 per year

Step-by-step explanation:

Data provided in the question;

Purchasing cost of the machine = $10.4 million

Transportation cost = $55,000

Salvage value = 0

Depreciable life = 5 years

Now,

Total cost of the machine involved

= Purchasing cost of the machine + Transportation cost

= $10.4 million + $55,000

= $10,400,000 + $55,000

= $10,455,000

thus,

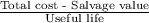

using the straight line method of depreciation

Annual depreciation =

Annual depreciation =

or

Annual depreciation = $2,091,000

Hence,

Depreciation expenses associated with this machine is $2,091,000 per year