Answer:

$5,450

Step-by-step explanation:

Data provided in the question:

List price of the machinery = $88,000

Discount offered = 10%

Amount of discount = 10% of $88,000

= 0.1 × $88,000

= $8,800

Shipping paid = $400

Sales tax = $4,900

Useful life = 10 years

Residual value = $30,000

Now,

Total cost of the machine = List price - Discount + Shipping + sales tax

= $88,000 - $8,800 + $400 + $4,900

= $84,500

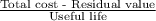

Annual depreciation using straight line method is given as:

=

=

= $5,450