Answer:

$886.78

Step-by-step explanation:

Data provided in the question:

Amount of bond issued = $250 million

Coupon rate = 12%

Face value, FV = $1,000

Coupon value, C = 12% of $1,000 = $120

Duration = 12 years

Required rate of return = 14%

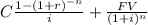

Price of a bond =

on substituting the respective values, we get

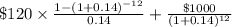

Price of a bond =

or

Price of bond = 679.23 + 207.55 = $886.78