Answer:

$16.16

Step-by-step explanation:

Given that,

Expected dividends:

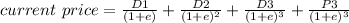

$1.05 in one year, D1

$1.24 in two years, D2

$1.35 in three years, D3

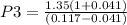

Growth rate of dividend, g = 4.1%

Equity cost of capital, e = 11.7 %

= 18.49

![current\ price=(1.05)/((1.117))+(1.24)/((1.117)^(2) )+[(1.35)/((1.117)^(3) )+(18.49)/((1.117)^(3) )]](https://img.qammunity.org/2020/formulas/business/college/1tmf0vk2f9kctxn7sr1f4qqwybng156us1.png)

= 0.94 + 0.99 + 14.23

= $16.16