Answer:

dividend one year D1 = $2.688

horizon value P1 = $36.9961

intrinsic value of portman stock P = $36.1290

dividend yield = 7.44 %

so correct option is b

Step-by-step explanation:

given data

dividend = $2.40 per share

expected to grow = 12%

constant rate = 2.40%

risk free rate = 3.00%

market risk premium = 3.60%

pormans beta = 1.90

solution

we find first dividend one year from now is

dividend one year = D × (1+g) ..................1

here D is given dividend and g is expected to grow rate put here value we get

dividend one year = $2.40 × (1+12%)

dividend one year D1 = $2.688

and

now we find cost of equity that is

cost of equity Ke = Rf + β ×market risk premium ..............2

Rf is risk free rate and β is pormans beta put these value

cost of equity Ke = 3% + (1.9 × 3.6%)

cost of equity Ke = 0.0984 = 9.84 %

so

horizon value is here

horizon value =

..................3

..................3

put here all value

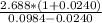

horizon value =

horizon value P1 = $36.9961

and

intrinsic value of portman stock is

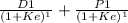

P =

...................4

...................4

put here value

P =

intrinsic value of portman stock P = $36.1290

and

dividend yield is here express as

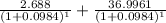

dividend yield =

......................5

......................5

put here value

dividend yield =

dividend yield = 7.44 %

so correct option is b