Answer:

The investor will pay up to $ 985.68

Step-by-step explanation:

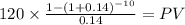

The market value of the bonds will be the discounted value of the coupon payment and maturity at discount rate of 14% which the investor requires

Coupon payment: 1,000 face value x 12% = 120

time to maturity: 12 years bond issued 2 years = 10 years

rate 0.14

PV $625.9339

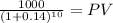

Maturity 1,000.00

time 10 years

rate 0.14

PV 269.74

PV coupon payment 625.94 + PM maturity $269.74 = $985.68