Answer:

days on inventory 57 + collection cycle 163- payment cycle 63

CCCT = 157 days

Step-by-step explanation:

The cash-to-cash measures the times from the company paid his good from the time it collect from the customer:

days inventory outstanding + collection cycle - payment cycle

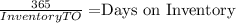

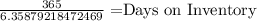

days inventory outstanding:

Where:

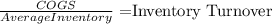

where:

COGS $ 1,790,000

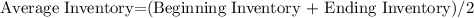

Beginning Inventory: $ 273,000

Ending Inventory: $ 290,000

Average Inventory: $ 281,500

Inventory TO 6.358792185

Days on Inventory 57

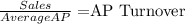

Collection cycle:

where:

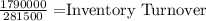

Purchases: 1,575,000

Beginning AP: 227,500

Ending AP: 316,200

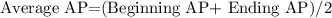

Average AP: 271,850

AP TO 5.793636196

payment cycle 63

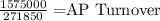

Collection cycle

Sales 102,000

Average AR 45,500

AR TO 2.241758242

collection cycle 163