Answer:

2014 Fixed Assets TO: 11.47

2015 Fixed Assets TO: 13.08

2106 Fixed Assets TO: 10.29

Step-by-step explanation:

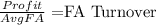

Fixed turnover ratio:

where:

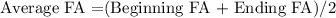

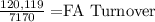

2014 DATA

Profit: 120,119

Beginning 4960

Ending 9380

Average 7170

Inventory TO 16.75299861

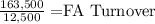

2015 data

Profit: 163,500

Beginning 9380

Ending 15,620

FA TO 13.08

2016

Profit: 167,910

Beginning 15,620

Ending 17,000

Inventory TO 10.2949111