Answer:

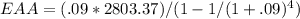

c. $865.31

Step-by-step explanation:

Data:

Project S

Initial Outlay = $15,000

Y1 CF = $7,000

Y2 CF = $12,000

Project L

Initial Outlay = $15,000

Y1 to Y4 CF = $5,200

To solve for Project S

In ordered to compare project S with project Project L, we shall prolong it to four years.

cashflow stream will be as follows:

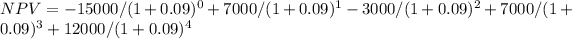

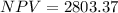

Y0=-$15,000 Y1=$7,000 Y2=-$3,000($12,000 CF - $15,000 outlay for prolonging the project second time) Y3=$7,000 Y4=$12,000

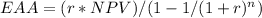

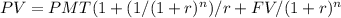

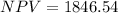

Following is the formula for Equivalent annual annuity

EAA = Equivalent annual equity

NPV = Net present value

r = Interest rate

n = Number of periods

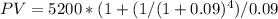

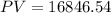

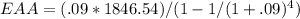

To solve For Project L

In order to calculate present value of the annuity, following formula will be used:

NPV = Initial outflow - Present Value

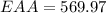

Using the above formula we can calculate EAA:

The most profitable EAA is of project S

*all figures are rounded off to two decimal points*