Answer:

Marginal tax rate is 0.15 or 15%

Step-by-step explanation:

Given data:

Taxable income is $18000

Tax liability is $2236

Additional amount to offer is $5000

Future tax liability is $2986

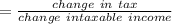

we know that marginal tax rate is computed as

Marginal rate

Marginal tax rate is 0.15 or 15%