Answer:

(a) Under plan 1:

EPS = EBIT ÷ Outstanding shares

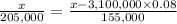

= $600,000 ÷ 205,000

= 2.93

Under plan 2:

EPS = EBIT ÷ Outstanding shares

= ($600,000 - $248,000) ÷ 155,000

= 2.27

(b) Under plan 1:

EPS = EBIT ÷ Outstanding shares

= $850,000 ÷ 205,000

= 2.93

Under plan 2:

EPS = EBIT ÷ Outstanding shares

= ($850,000 - $248,000) ÷ 155,000

= 3.88

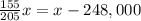

(c) Break-even EBIT is the amount of EBIT in which EPS of plan 1 is equal to the plan 2.

Let x be the break-even EBIT,

![248,000=x[1-(155)/(205)]](https://img.qammunity.org/2020/formulas/business/college/6x3a37duqiggnomg0z6rgufku97fxh95ze.png)

x = $1,016,800