Answer:

It can pay up to $ 689.012 annual maintenance cost for the van at the MARR of 20%

Step-by-step explanation:

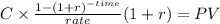

Present value of the lease:

C 3,000.00

time 3 years

rate 0.2

PV $7,583.3333

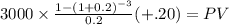

Now, present value of the van:

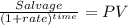

7,000 - salvage value + maintenance cost

Salvage: 1,500.00

time 3 years

rate 0.20000

PV 868.0556

7,000 - 868.06 = 6.131,94

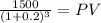

the maximum maintenance cost should match the lease:

lease Present worth 7,583.3333

purhcase Present worth (6.131,94)

PV of maintenance: 1,451.39

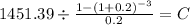

We know calculate the quota which matches this PV:

PV 1,451

time 3

rate 0.2

C $ 689.012