Answer:

D. 4,463 units

Step-by-step explanation:

contribution margin per unit:

sales revenue - variable cost

150 - 120 = 30 dollars

each units generates 30 dollars to afford fixed cost and make a gain.

The depreciation will not generate a cash outlay but will generate a tax shield but, we should ignore taxes so the depreciaiton information must be disregard.

The financial break.even point will retrun the amount of units per year we need to sale to achieve the 10% on all cost

financial cash outlay:

F0 300,000

Equivalent Annual cost:

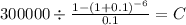

PV $300,000.00

time 6 years

rate 10% = 10/100 = 0.1

C $ 68,882.214

We also have 65,000 annual fixed cost thus, total annual financial cost:

68,882.21 + 65,000 = 133,882.21

Now, we divide this amount by the 30 dollar each unit generates to know the break even point:

133,882.21 / 30 = 4,462.74 = 4,463