Answer:

$2313.51

Explanation:

Here we calculate the future value for each cash flow and add them up.

Given he deposited $700 at the end of the first year .

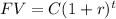

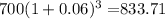

Here time to maturity is 3years and interest rate is 6%.

=

=

Given he deposited $500 at the end of the second year .

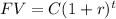

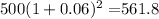

Here time to maturity is 2 years and interest rate is 6%.

=

=

.

.

Given he deposited $300 at the end of the third year .

Here time to maturity is 1years and interest rate is 6%.

=

=

.

.

Also given that he deposited $600 at the end of fourth year .There will be no interest on this amount as it is done at the end.

Terminal value=833.71+561.8+318+600=$2313.51