Answer:

(i) 62,315 units

(ii) 810,101.00

Step-by-step explanation:

a-1. Depreciation = Project cost ÷ Years of life

= $630,700 ÷ 7

= $90,100

Therefore,

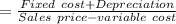

Accounting break-even point:

= 62,315 units

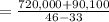

a-2. Degree of operating leverage at the accounting break-even point:

= 1 + (Fixed cost + Operating cash flow)

= 1 + (720,000 + 90,100) [∴ Depreciation is the only OCF at this point]

= 1 + 810,100

= 810,101.00