Answer:

net present value = 15452.63

present value of future monthly payment = 11301.56

resale price= 31151.05

Step-by-step explanation:

given data

buy costs = $38,500

monthly rate = 7 % =

no of period = 2 × 12 = 24

solution

we find present value of resale is

present value =

present value = 23047.37

so

net present value of purchase car is = purchase cost - present value

net present value = 38500 - 23047.37 = 15452.63

and

present value of future monthly payment is

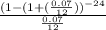

present value of future monthly payment = 506 ×

present value of future monthly payment = 11301.56

so present value of leasing car = today payment + present value of future monthly payment

resent value of leasing car = 106 + 11301.56

resent value of leasing car = 11407.56

we consider resale price = x

so break even sale price = 38500 -

solve we get

x = 31151.05

so resale price= 31151.05