Answer:

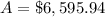

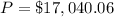

Part 1)

Part 2)

Part 3)

Part 4)

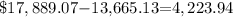

Part 5) The Option A is the best way to invest the money by $4,223.94 than Option B

Explanation:

Part 1)

we know that

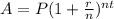

The compound interest formula is equal to

where

A is the Final Investment Value

P is the Principal amount of money to be invested

r is the rate of interest in decimal

t is Number of Time Periods

n is the number of times interest is compounded per year

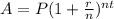

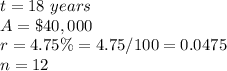

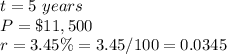

in this problem we have

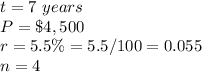

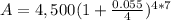

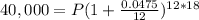

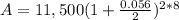

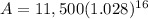

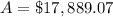

substitute in the formula above

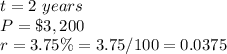

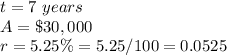

Part 2)

we know that

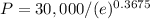

The formula to calculate continuously compounded interest is equal to

where

A is the Final Investment Value

P is the Principal amount of money to be invested

r is the rate of interest in decimal

t is Number of Time Periods

e is the mathematical constant number

we have

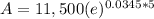

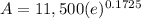

substitute in the formula above

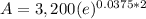

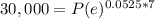

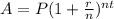

Part 3)

we know that

The compound interest formula is equal to

where

A is the Final Investment Value

P is the Principal amount of money to be invested

r is the rate of interest in decimal

t is Number of Time Periods

n is the number of times interest is compounded per year

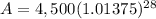

in this problem we have

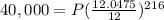

substitute in the formula above

![P=40,000/[((12.0475)/(12))^(216)]](https://img.qammunity.org/2020/formulas/mathematics/high-school/i5xnz888cole62qc4kg1trkvp1hsazoaaf.png)

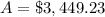

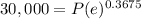

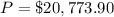

Part 4)

we know that

The formula to calculate continuously compounded interest is equal to

where

A is the Final Investment Value

P is the Principal amount of money to be invested

r is the rate of interest in decimal

t is Number of Time Periods

e is the mathematical constant number

we have

substitute in the formula above

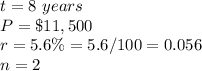

Part 5)

Option A

we know that

The compound interest formula is equal to

where

A is the Final Investment Value

P is the Principal amount of money to be invested

r is the rate of interest in decimal

t is Number of Time Periods

n is the number of times interest is compounded per year

in this problem we have

substitute in the formula above

Option B

we know that

The formula to calculate continuously compounded interest is equal to

where

A is the Final Investment Value

P is the Principal amount of money to be invested

r is the rate of interest in decimal

t is Number of Time Periods

e is the mathematical constant number

we have

substitute in the formula above

Compare the options

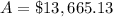

Option A ------>

Option B ----->

so

Option A > Option B

Find out the difference

therefore

The Option A is the best way to invest the money by $4,223.94 than Option B