Answer:

Explanation:

Q1.

Use FV formula to get value at year 7

FV= PV

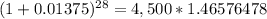

Since it's quarterly compounding, quarterly rate would be (5.5% / 4)= 1.375% and total duration t would be 7*4 = 28 quarters

FV= 4,500

FV= $6,595.94

Q2.

Future Value with continuous compounding formula; FV= PV

Note: the "e" is an exponential

FV= 3,200

FV = 3200* 1.0778841

FV= $3,440.229

Q3.

Here, you find Present value; PV =

Since it's monthly compounding, monthly rate would be (4.75% / 12)= 0.3958% and total duration t would be 18*12 = 216 months

PV=

PV= 40,000/2.3472409

PV= 17,041.2845

Therefore you need to invest $17,041.28.

Q4.

Use PV with continuous compounding formula here;

PV=

Note: the "e" is an exponential

PV =

PV= 30,000/1.4441198

PV = $20,773.8998

Therefore, you need to invest $20,773.90 now.

Q5.

Compare the FV of each option and choose the highest;

a.) FV= PV

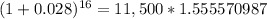

Since it's semi-annual compounding, semi-annual rate would be (5.6% / 2)= 2.8% and total duration t would be 8*2 = 16

FV = 11,500

FV= $17,889.07

b.)Future Value with continuous compounding formula; FV= PV

Note: the "e" is an exponential

FV= 11,500

FV= 11,500 * 1.188271821

FV= $13,665.126

Therefore, Option A is a better option by $4,223.94