Answer:

No, I would not accept the project.

Step-by-step explanation:

The initial investment will be equipment cost of $200,000 plus working $15,000 totaling to $215,000.

The cash flow after tax will be $26,000 {$40,000 x (1 - 35% tax rate)}

The salvage value of the equipment is $70,000 plus working capital of $15,000 totaling to a value of $85,000.

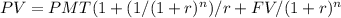

Following formula will be used to calculate present value of annuity payment of $26,000 for four years and present value of $85,000:

PV = Present Value

PMT = Annuity Payment

r = Interest Rate

FV = Future Value

n = Number of periods

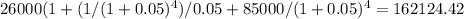

Calculation

Data:

r = 5%

n = 4

PMT = $26,000

FV = $85,000

The net present value of the project is $215,000 - $162,124.42 = $-52,875.58

The project is not economically valuable.