Answer:

57,000 overstated

Step-by-step explanation:

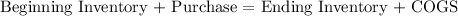

the inventory identity is as follows:

Beginning invenotry and purchases cannot be alter as they are past measurement.

The impact of the overstated inventory mkaes the cost of good sold be 57,000 dollar less therefore; net income is misstated by 57,000 as well.

Because the COGS decreases the income a lower COGS generates an overstated net income.