Answer:

So the firm's current stock price will be $40.88

Step-by-step explanation:

We have given that Enterprises expected earnings next year is $3.68

So EPS next year = $3.68

Retention rate is given as 40%

Dividend payout ratio = 100 - 40 = 60 %

Dividend paid next year = $3.68×0.6 = $2.208

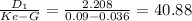

We know that price of the stock =

So the firm's current stock price will be $40.88