Answer:

The maximum price you would be willing to pay is $13.33 (Option C).

Step-by-step explanation:

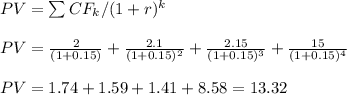

The maximum price that you are willing to pay is equal to the sum of the present value of the returns (dividends plus selling price), at a discount rate of 15%.

We can calculate the present value as:

The maximum price you would be willing to pay is $13.33 (Option C).