Answer:

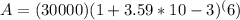

$ 30652USD

Explanation:

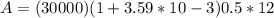

We need to define our data. We understand that the debt was made to finance studies. The loan requested was

P = $ 30,000USD (At least that is what is understood from the question, even if the numbers are wrong)

The number of deferred months is 66 (or 6? Is not clear in the fingering) I will assume 6, since stopping a debt for 66 months is not practical in real life.

So time in years is defined by,

t = 6/12

t = 0.5 years

Our interest rate is 4.31%

r = 4.31%

The number of periods per year is 12, so,

m = 12,

![i = \frac {4.31%} {12} = 3.5916*10 ^(-3)]()

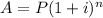

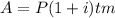

Replacing in the formula of your money is,

A = 30652

This way when the payment begins, he will have to start paying a debt of $ 30652USD