Answer:

The interest rate for the euro zone to avoid arbitrage has to be C) 8.62%

Step-by-step explanation:

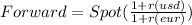

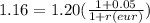

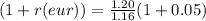

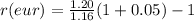

Hi, we need to solve for r(eur) the following equation in order to find an interest rate that will avoid arbitrage.

That is:

So, the euro zone rate to avoid arbitrage is 8.62%, which is option C)

Best of luck.