Answer:

The installment will be for $ 4,148.010

Step-by-step explanation:

There will be 7 payment starting at the beginning of the third year therefore, an annuity-due. Then It will capitalize one more year.

Thus, the annuity future value will be the 50,000 discounted one year.

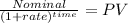

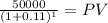

Nominal: 50,000.00

time: 1 year

rate: 11% = 11/100 = 0.11

PV= 45,045.0450

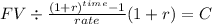

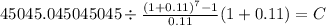

Then we need to solve for the PMT of this annuity:

PV: $ 45,045

time: 7 years

rate: 11% = 11/100 = 0.11

C $ 4,148.010