Answer:

a)

$34.4

b)

$37.20

c) $59.57

Step-by-step explanation:

Given:

Dividend paid = $2.15

Growth rate = 4% = 0.04

Required return = 10.5% = 0.105

Now,

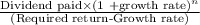

a) Present value =

for the current price n = 1

thus,

Current price =

=

= $34.4

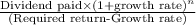

b) Price in 3 years

i.e n = 3

=

=

=

$37.20

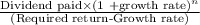

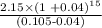

c) Price in 15 years

i.e n = 15

=

=

= $59.57