Answer:

(a) 14.84

(b) (i) 10.78%

(ii) 9.97%

Step-by-step explanation:

D1 = D0 × (1 + Growing rate)

= 1.6 × 1.2

= 1.92

D2 = D1 × (1 + Growing rate)

= 1.92 × 1.2

= 2.304

P2 = [D2 × (1 - gn)] ÷ (rs + gn)

= (2.304 × 0.94) ÷ (10%+6%)

= 13.536

Current price:

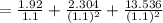

= 14.84

Expected dividend yield = D0 ÷ Current price

= 1.6 ÷ 14.84

= 10.78%

P1 = [D2 ÷ (1+rs)] + [P2 ÷ (1+rs)]

= 2.304/1.1 + 13.536/1.1

= 14.4

Capital gains yield = P1 - Current price + (D1 ÷ Current price)

= 14.4 - 14.84 + (1.92 ÷ 14.84)

= 9.97%