Answer:

n = 33.8108479

Step-by-step explanation:

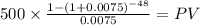

We will calculate the current principal

And then calculate the time period it takes with a higher payment of 675 dollars per month:

C $ 500

time 48 ( 4 years x 12 months per year)

rate 0.0075 (9% annual divide by 12 months)

PV $20,092.3909

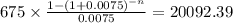

Now we recalculate n:

C $675.00

time n

rate 0.0075

PV $20,092.3900

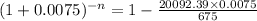

from the annuity formula we solve as we can until arrive at this situation:

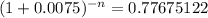

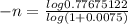

We use logarithmics properties to solve for n:

n = 33.8108479