Answer:

d. The stock's price one year from now is expected to be 5% above the current price

Step-by-step explanation:

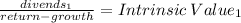

From the dividend grow model we got that price of a share is:

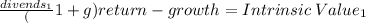

next year the dividend will be higher in proportion to dividend growth:

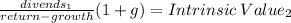

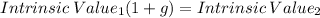

Thus, we can rearrenge as:

This makes d statement correct.