Answer:

arket price of the new bond: $1,103.66

Step-by-step explanation:

We solve for the market rate using excel goal seekor a financial calculator

Considering the current market value of the bond is equal to the present value of the coupon payment and maturity:

Coupon payment are ordinary annuity

While the maturity is a lump sum

The bond is the sum of both.

from this we got that market rate is equal to 0.0516

Now, we can determinate the presetn value of the new bond using this rate:

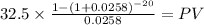

C 32.50 (1,000 face value x 6.5% / 2)

time 20 (10 years x 2 payment per year)

rate 0.0258 (5.16% annual rate divide by 2 coverted to semiannual)

PV $502.8400

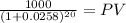

Maturity: Face value of $ 1,000.00

time and rate same as the coupon payment

PV 600.82

PV coupon $502.8400 + PV maturity $600.8224 = $1,103.6624