Answer:

$11,250

Step-by-step explanation:

Given:

Cost of inventory acquired = $100,000

Total number of product LF = 3,000

units of product 1B = 7,000

Selling price of LF = $30 per unit

Selling price of 1B = $10 per unit

Number of units of LF sold = 1000

Now,

Total Selling price = 3000 × $30 + 7,000 × $10

= $9,000 + $7,000

= $160,000

Overall Gross profit = Total Selling price - Cost of inventory acquired

= $160,000 - $100,000

= $60,000

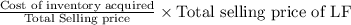

The proportion of cost for LF =

=

= $18.75

Cost of 1000 units of LF = 1000 × $18.75 = $18,750

Sale price of 1000 units of LF = 1000 × $30 = $30,000

Therefore,

Gross profit to be recognized for 1000 units of LF = $30,000 - $18,750

= $11,250