Answer:

18.29%

Step-by-step explanation:

Return on Equity is the net profit available for equity/ Total equity value.

Total equity = Total assets - Total debt

= $90 million - $55 million = $35 million

Earnings for equity = Annual sales

net profit margin 4%

net profit margin 4%

= $160 million

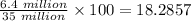

4% = 6.4 million

4% = 6.4 million

Therefore, return on equity =

=

Therefore, ROE = 18.29%