Answer:

d. $34.87

Step-by-step explanation:

We need to calcualte the value of the company. This is done by addingthe present vbalue of the future free cash flow of the firm.

FCF0 = 1.32 (current accounting period)

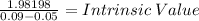

FCF 1.32 + 30% = 1.716

FCF2 FCF1 + 10% = 1.716 x 1.1 = 1.8876

FCF3 FCF + 5% = 1.8876 x 1.05 = 1.98198

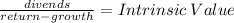

From here after we use the gordon model:

WACC = 9%

grow = 5%

we use FCF instead of dividends: 1.98198

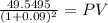

Value of the future cash flow 49,5495

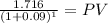

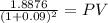

Now, as this are in the future we must adjust using the present value of a lump sum:

PV 1.5743

PV 1.5888

PV 41.7048

Total: 1.5743 + 1.5888 + 41.7048 = 44,8679

Now we adjust for shrot term investment and debt outstanding:

vresent value of the future cash flow 44,8679

short term investment: 4.0000

debt outstanding (14.000)

Net: 34.8679