Answer:

The investors should be willing to pay $49.50 for this stock

Step-by-step explanation:

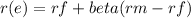

Hi, first, we need to find out what the cost of equity is in order to find the price of the stock. that is:

Where:

rf= Risk free rate

rm=return on the market

r(e)=cost of equity

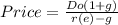

After finding r(e), we would need to find the price using the following equation.

Where:

Do= last dividend

g= growth rate

r(e)= cost of equity.

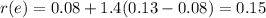

ok, so, let´s find out what the cost of equity is.

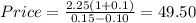

So, the r(e)=15%, now let´s find the price of this stock

Therefore, the price of this stock is $49.50

Best of luck.