Answer:

The most economic option is: Option 1. because the present value of the costs is lower than Option 2.

Step-by-step explanation:

Hi, first we need to introduce the equation to find the present value of a perpetuity, that is:

Annuity= consist in the amount to be paid periodically (not necessarily every year)

r = The discount rate that coincides with the periodicity of the annuity.

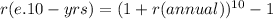

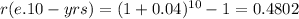

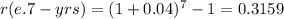

So, there are different periodities in both options. In option 1, every 10 years and forever the dome needs to be sandblast, therfore we need to find the effective equivalent rate to 4% annual (MARR=4%). That is:

therefore

So, the equivalent effective 10 years rate to MARR=4% is 48.02%

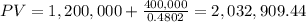

Now, the cost of this option is:

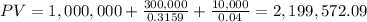

On the other hand, Option 2. has 2 periodicities we need to take into consideration, first is the sandblasting process that need to be performed every 7 years and the annual maintenance cost, so we need to find the effective 7 year rate to bring to present value this anuity (sandblasting cost)

o, the equivalent effective 7 years rate to MARR=4% is 31.59%

Now, the cost of Option 2 is:

For all of the above, we can conclude that the best choice is Option 1, because it is cheaper that Option 2.

Best of luck.