Answer:

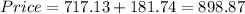

The current price of the bond would be € 898.87

Step-by-step explanation:

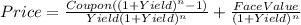

Hi, we need to bring to present value the coupon payments and also the face value of the coupon in order to find the price of this bond, that can be done by using the following formula.

Where:

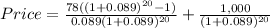

Coupon = 1,000*0.078=78

Yield = 0.089 (or 8.9%)

Face Value= 1,000

n = 20 coupon payments

So, everything should look like this.

Therefore, the price of this bond is € 898.87

Best of luck.