Answer:

intrinsic value: 49.50

value in four years: $ 61.32

value in fourteen years: $ 104.75

Step-by-step explanation:

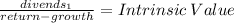

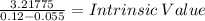

we solve using the gordon model:

D0 = 3.05

D1 = 3.05 x ( 1 + 0.055) = 3.21775

Value: 49.50384615

In the future will grow at the same rate as dividends:

price in four years: 49.50 x (1.055)^4 = 61.32182021

price in fourteen years: 49.50 x (1.055)^14 = 104.7465274