Answer:

10.60%

Step-by-step explanation:

First, we calcualte the returns and then solve for the rate like a normal compounding:

returns:

annual coupon payment. 1,000 face value x $ 13.68 = $ 136.80

sales price: 913.73

total: 136.8 x 6 + 913.73 = 820.80 + 913.73 =

cost: 947.68

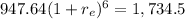

to record the effective rate of return:

![\sqrt[6]{(1,734.5)/(947.68)} -1 = r_e](https://img.qammunity.org/2020/formulas/business/college/161vgr41zmzi6g6pfk4w6u9g1kdawybjw3.png)

effective rate of return: 0.105992287 = 10.60%