Answer:

Yes It will be accepted.

As the present worth (cost) of the water filtration

is far less than paying to Bay City for the purification

It decrease to $96,890.53 from $214,210.43 of the Bay Ciity Option

Step-by-step explanation:

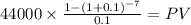

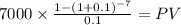

Present worth if the system is not purchased:

C $ 44,000.00

time 7 years

rate 0.1

PV $214,210.4280

We will now compare the value of the water filtration system:

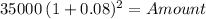

F0 investment: 70,000 / 2 = 35,000

loan payment:

principal after two-years grace period:

rate 0.08000

Amount 40,824.00

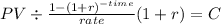

Then there is 3 payment annuity-due as it begins at the beginning right away after the grace period:

PV 40,824

time: 3 years

rate 0.08

C $ 14,667.667

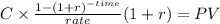

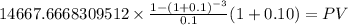

Present value of the annuity discounted at Minimim accepted rate of return of 10%:

C 14,667.67

time years 3

rate 0.1

PV $40,123.9481

Maturity 40,123.95

time 2.00

rate 0.10000

PV 33,160.29

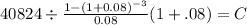

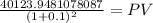

present value of the maintenance expenses:

C $ 7,000.00

time 7 years

rate 0.1

PV $34,078.9317

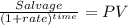

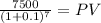

Present value of the salvage value:

Salvage: $7,500.00

time 7 years

rate 0.10000

PV 3,848.69

Present worth of the water filtration system:

33,500 + +33,160.29 + 34,078.93 - 3,848.69 = 96,890.53