Answer:

option (C) 50 +

Explanation:

Data provided :

income tax = add 2 percent of one’s annual income to the average (arithmetic mean) of 100 units of Country R’s currency and 1 percent of one’s annual income

Annual income = I

Now,

2% of annual income = 0.02 × I

and,

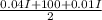

the average of 100 units of Country R’s currency and 1 percent of one’s annual income

=

Therefore,

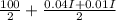

Total income tax = 0.02 × I +

or

=

=

= 50 +

= 50 +

or

= 50 +

= 50 +

Hence, the correct answer is option (C) 50 +