Answer:

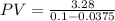

52.48

Step-by-step explanation:

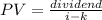

the key to answer this is to keep in mind that we are giving the value of the increasing dividend 3.75%, so the theory says that present value of a perpetuity payment is as follows:

where dividend is the payment as dividend, i is the interest rate and k is the increment of the dividend, so we have:

so you will pay 52.48 for this stock today