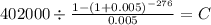

Answer:

E. $2,688.77

Step-by-step explanation:

We need to calculate the PMT of an ordinary annuity at 6%

PV 402,000

time:

85 years - 62 years = 23 years of retirement

23 years x 12 months per year = 276 months

rate: 6% annual rate we must divide over 12 months to convert into monthly: 0.06/12 = 0.005

C $ 2,688.766

She can withdraw 2,688.76 per month