Answer:

a) unlevered: 1.75 EPS

levered: 1.60 EPS

b)unlevered: 3.00 EPS

levered: 3.27 EPS

c) EBIT break even point: 440,000 dollars

at this point is indifferent which plan the firm chose.

Step-by-step explanation:

unlevered firm:

200,000 shares (100%)

levered firm

150,000 shares (75%)

Debt: $2,200,000 (25%)

a) EBIT: 350,000

unlevered: 350,000/200,000 = 1.75 EPS

levered: (350,000-2,200,000x5%)/150,000 = 1.6 EPS

b) EBIT: 650,000

unlevered: 600,000/200,000 = 3 EPS

levered: (600,000-2,200,000x5%)/150,000 = 3.27 EPS

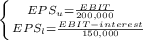

c) we should build and equation system at which both plans get the same EPS:

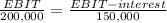

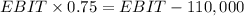

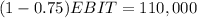

We equalize and solve for EBIT:

interest is: 2,200,000 x 5% = 110,000

EBIT = 440,000