Answer:

$64,474.20

Step-by-step explanation:

As for the information provided,

discount rate = 7.25%

First payment will be made at the end of year 1

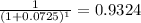

Discounting factor =

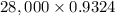

Thus, current value of payment =

= $26,107.20

= $26,107.20

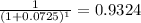

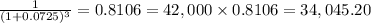

Discounting factor for receipts =

Year 1 =

= $28,000

= $28,000

0.9324 = 26,107.20

0.9324 = 26,107.20

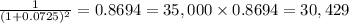

Year 2 =

Year 3 =

Therefore, value of contract today = - $26,107.20 + $26,107.20 + $30,429.0 + $34,045.20 = $64,474.20