Answer:

overhead rate: 0.8188

applied overhead: 2,169,820

overapplication: 469,820

Step-by-step explanation:

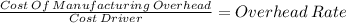

predetermined overhead:

We distribute the overhead over the cost driver. In this case labor cost:

1,785,000 / 2,180,000 = 0.8188

each dollar of labor cost generated 0.8188 of overhead.

applied overhead:

actual labor cost x rate:

2,650,000 x 0.8188 = 2,169,820

actual overhead: 1,700,000

overapplication of overhead: 469,820

we capitalize more cost than actual incurred we should decrease our COGS