Answer:

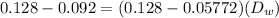

D_w = 51.2236%

E_w = 48.7764%

Step-by-step explanation:

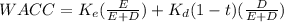

From the WACC formula we can solve for the weight

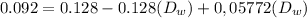

as Ew + Liabilities weight = 1

we can express Ew as (1-Liabilities weight)

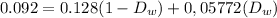

Ke 0.128

Kd 0.074

t 0.22

after tax debt: 0,05772

WACC 0.092

D_w = 0,512236

E_w = 1 - 0.51236 =0.487764